AEC Stakeholders Try to Navigate Choppy Trade Waters

Since early April, when U.S. President Donald Trump’s administration first announced reciprocal tariffs on a variety of goods around the global trade economy, business analysts and professional associations have attempted to make stable and sustainable recommendations on the way forward.

As writer Janelle Penny explains in "How Is Tariff Uncertainty Affecting Interior Designers?" given the 90-day pause on many country-specific tariffs and the negotiations that are underway, at this time it remains challenging to predict the full extent of increased tariffs on supply chains and the trickle-down to manufacturers, buyers, and specifiers.

Still, we know that “capital-T” tariffs will be a hot button issue for the foreseeable future, so we sought to fill in the gaps with responses and insights we’ve seen and heard from around the marketplace.

Initial Market Responses

From a broader real-estate development vantage point, Endeavor Group Real Estate (EGRE) managing partner Richard Rubin said that tariffs will certainly impact new builds, which could increase prospects for adaptive reuse projects. Even then, architectural and interior designers tasked with planning space improvements will find it challenging to navigate the murky waters of reciprocal tariffs and vendor surcharges as they specify projects far in advance.

Through its Endeavor Business Intelligence (EBI) division, Endeavor Business Media (unrelated to EGRE)—the parent company of i+s—captured a snapshot survey across vertical markets in early April, collecting responses from more than 400 business professionals.

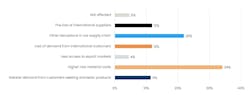

A question we found to be of particular interest in the report was “In what ways do you expect your business to be most affected by the tariffs?” Participants were instructed to choose two out of seven options. By and large, the greatest expected impact was higher raw material costs (not surprising), with additional supply chain disruptions coming in second. According to the analysts, the responses indicate that “for many companies, the most immediate consequences of tariffs are cost increases and logistical headaches, not just shifts in global demand.”

Still, 11 percent of survey respondents said that they expected increased demand from customers seeking domestic suppliers and finished products.

In a similar vein, conversations with exhibitors regarding tariffs at May’s Hospitality Design (HD) Expo reiterated the value of lessons learned during the pandemic:

- Evaluate product lines for the most stable position compared to competitors before implementing customer surcharges.

- Shrink supply distances, and seek more localized sources as much as possible.

- Ramp up onshoring where it is most cost-effective.

- Bring more focus to quick-ship programs and maintain a close eye on what the most popular items tend to be.

For example, HD Expo exhibitor Shaw Contract's representatives mentioned that the company opened a North Georgia manufacturing facility and pulled a significant amount of its product manufacturing out of China during COVID in order to reduce delays.

Seating manufacturers emu Americas and Danao highlighted their quick ship programs in our discussions. In fact, Katerina Triska at emu Americas told i+s that in-stock quick ship products constitute about 80% of the company’s sales, and they don’t incur any additional customer surcharges. Given the long lead times on design projects, Triska said, “sometimes we can even substitute a product for one that has been put on hold” due to changing sourcing decisions. Danao’s quick-ship marine-grade indoor/outdoor furnishings are stocked in North Carolina for fast turnaround.

Trade Talk

Still, manufacturers and industry stakeholders aren’t sitting pretty in their collective loungers when it comes to trade considerations.

In February, commercial furniture manufacturer’s association BIFMA released a position statement on the status of trade and tariffs, cautioning the administration against “any drastic tariff implementations” that could undermine the United States-Mexico-Canada Agreement (USMCA), due to the number of furniture manufacturers that have developed hybrid production models and supply chains within North America since the COVID-19 pandemic.

According to BIFMA, commercial furniture manufacturing takes place in 48 states and contributes close to $15 billion annually to the U.S. economy. The association expressed concerns that tariffs on Canada and Mexico would undo the progress that the furniture manufacturing industry has made toward onshoring and shortening supply chain times and distances.

As of the time of publication, BIFMA has not released an updated tariff statement. However, the USMCA is on course to be reviewed in 2026, reported our colleague Jill Jusko at IndustryWeek, and quoted trade experts noted that all three nations have incentive to revisit the agreement and determine how it will hold under new tariff considerations.

Some market actors like The Mitchell Group’s EVP Ann Brunett have made public statements about the inconsistency of trade policy impacts across sectors, citing the lack of suitable American-made product and mixed messages from the administration about the desire for reshoring.

In statements to CNN and in a collective Washington Post op-ed, Brunett observed that textile manufacturing appears to be disproportionately affected where there is minimal alternative supply chain for certain types of coated fabrics outside of China. Years of building those supply chain relationships are in jeopardy, as Brunett and The Mitchell Group president Bill Fisch pointed out that they have yet to find production alternatives in Vietnam, India, Malaysia, or Europe.

For the time being, a cautious approach to long-term pricing strategies for manufacturers seems reasonable, while design professionals would do well to advise clients of potential budget constraints and proactively encourage more domestic product selection.

References

1. McKinsey, “Tariffs and Global Trade: The Economic Impact on Business,” April 18, 2025.

2. BIFMA Tariff Position Statement, February 18, 2025.

3. Endeavor Business Intelligence, “Pulse Report: Impact of Trump’s New Tariffs on Businesses,” April 8, 2025.

4. Building Design + Construction, “Trump 2.0: Tracking the Trump Administration’s Impact on the U.S. Building Construction Industry.”

5. CNN, “How Trump’s 145% China tariffs could crush American small businesses: ‘There’s no facility here that makes what we need’”, April 26, 2025.

6. Washington Post, “Makers of clothes, beer and more on what tariffs really mean for you,” May 5, 2025.

About the Author

Carrie Meadows

Editor-in-Chief

Carrie Meadows is Editor-in-Chief of interiors+sources (i+s), where she leads editorial strategy, content development, and brand storytelling focused on the people, projects, and innovations shaping the design industry. With more than two decades of experience in B2B media, she has built a career connecting technical expertise with creative insight—translating complex topics into meaningful stories for professional audiences. Before joining i+s in 2024, Carrie served as Editor-in-Chief of LEDs Magazine within Endeavor Business Media’s Digital Infrastructure & Lighting Group, guiding coverage of emerging lighting technologies, sustainability, and human-centric design. Her earlier editorial experience spans across Laser Focus World, Vision Systems Design, Lightwave, and CleanRooms, where she managed print and digital publications serving the optics, photonics, and semiconductor sectors.

An advocate for clear communication and thoughtful storytelling, Carrie combines her editorial management, SEO, and content strategy expertise to help brands and readers stay informed in a rapidly evolving media landscape. When she’s not crafting content, Carrie can be found volunteering at a local animal shelter, diving into a good crime novel, or spending time outdoors with family, friends, and her favorite four-legged friends.